![[*]](crossref.png) of chapter

of chapter ![[*]](crossref.png) ) that

) that

![[*]](crossref.png) of chapter

of chapter ![[*]](crossref.png) ) that

) that

In computer experiments, the parameters of the model can be chosen as follows

![[*]](crossref.png) , section

, section ![[*]](crossref.png) for a justification)

for a justification)

Plot typical trajectories of the Cox-Ross-Rubinstein process for

different values of ![]() (from

(from ![]() to

to ![]() ). Note that the price

of options does not depend on the value of

). Note that the price

of options does not depend on the value of ![]() (see

chapter

(see

chapter ![[*]](crossref.png) ).

).

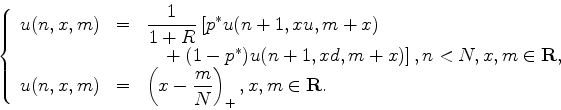

By a time shift argument write a function Price(n,N,K,R,up,down,x) which computes the price at time ![]() , when the

asset value is

, when the

asset value is ![]() , at this time.

, at this time.

Consider an Asian call whose payoff at time ![]() is given by

is given by

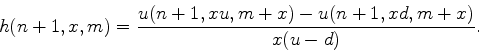

![[*]](crossref.png) prove that the price at time

prove that the price at time