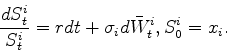

In order to correlate the assets we assume that

![]() is a vector of independent Brownian

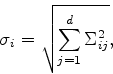

motions, that

is a vector of independent Brownian

motions, that ![]() is a

is a ![]() matrix, and we define

matrix, and we define

![]() by

by

![\begin{displaymath}

\bar{W}^i_t = \frac{[\Sigma W_t]_i}{\sigma_i}

= \frac{\sum_{j=1}^d \Sigma_{ij} W^j_t}{\sigma_i}.

\end{displaymath}](img9.png)

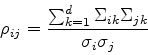

Note that

![]() , where

, where

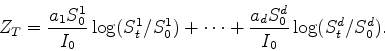

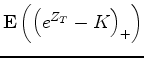

Compute, using a Monte-Carlo method, the price of a call

whose payoff is given at time ![]() by

by

Do the same computation for an index put whose payoff is given by

![]() .

.

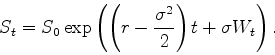

We recall the following formula (Black-Scholes formula, exercise)

Use this formula to give an explicit expression to

and propose

a control variate technique for the computation

of the call option.

and propose

a control variate technique for the computation

of the call option.

Compare this method to the standard one for different values of

![]() .

.

Prove, using simulation, that the relative precision of the

computation decrease when ![]() increase. Take

increase. Take ![]() and

and ![]() ,

,

![]() ,

, ![]() ,

, ![]() . What happen when

. What happen when ![]() ?

?