The Vasicek model is presented in Chapter ![[*]](crossref.png) .

The short rate

.

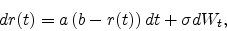

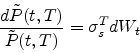

The short rate  follows the stochastic differential equation

follows the stochastic differential equation

|

(1) |

where  ,

,  ,

,  are positive constants and

are positive constants and  is a standard

Brownian motion under

is a standard

Brownian motion under  . In computer experiments, one

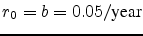

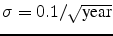

can choose

. In computer experiments, one

can choose

,

,

,

,

.

.

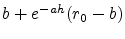

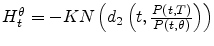

- Show that

follows a Gaussian distribution with mean

follows a Gaussian distribution with mean

and variance

and variance

- What is the conditional distribution of

given

given  ?

?

- Explain how to sample exactly the vector

.

.

- Implement the suggested algorithm and plot the trajectory

for

for  hour,

hour,  day,

day,  week and

week and

.

.

We denote by  the price at time

the price at time  of a zero-coupon with

maturity date

of a zero-coupon with

maturity date  . We assume that

. We assume that  is a probability

under which all the discounted bond price

is a probability

under which all the discounted bond price

are martingales.

- We know (see chapter

![[*]](crossref.png) ) that

the zero coupon bonds can be written as

) that

the zero coupon bonds can be written as

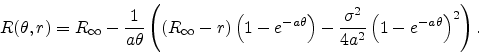

with :

and

.

.

Sample the discretised trajectory price of a bond with maturity

where

where  day and is such that

day and is such that

year.

year.

Here, we consider a call option in the Vasicek model, with maturity

on a zero-coupon bond with maturity

on a zero-coupon bond with maturity  ,

,  . We want to

implement a hedging strategy for this option.

. We want to

implement a hedging strategy for this option.

- Show, using the results of Chapter

![[*]](crossref.png) , that

, that

where

-

Show using Proposition

![[*]](crossref.png) that the price

that the price  of the call option at time

of the call option at time

, is given by

, is given by

with

where  is the cumulative normal distribution function,

is the cumulative normal distribution function,

and

Implement this formula and plot the option price at time  as a function of the strike

as a function of the strike  .

.

- Using Exercise

![[*]](crossref.png) of this chapter, show that

of this chapter, show that

and

and

.

.

Implement these formulae and plot the values of  and

and

as a function of the strike

as a function of the strike  .

.

Give a perfect hedging portfolio for the call option using only zero

coupon bonds with maturity  and zero coupon bonds with maturity

and zero coupon bonds with maturity

.

.

-

We are interested in studying discrete approximation of this

perfect hedging portfolio in which the quantity

of

zero coupon bonds with maturity

of

zero coupon bonds with maturity  remains

constant on the interval

remains

constant on the interval ![$[kh,(k+1)h]$](img48.png) and equal to

and equal to  .

.

, the quantity of zero coupon bonds with

maturity

, the quantity of zero coupon bonds with

maturity  , is determined using the discrete self-financing

condition at times

, is determined using the discrete self-financing

condition at times  .

.

For a given  (successively chosen to be

(successively chosen to be  day,

day,  week,

week,

month) sample the residual risk of this approximated hedging

portfolio. Plot a histogram of the residual risk and study the

values of its mean and its variance when

month) sample the residual risk of this approximated hedging

portfolio. Plot a histogram of the residual risk and study the

values of its mean and its variance when  decreases to

decreases to  .

.

![[*]](crossref.png) .

The short rate

.

The short rate ![[*]](crossref.png) .

The short rate

.

The short rate ![]() follows the stochastic differential equation

follows the stochastic differential equation

![]() the price at time

the price at time ![]() of a zero-coupon with

maturity date

of a zero-coupon with

maturity date ![]() . We assume that

. We assume that ![]() is a probability

under which all the discounted bond price

is a probability

under which all the discounted bond price

![[*]](crossref.png) ) that

the zero coupon bonds can be written as

) that

the zero coupon bonds can be written as

![]()

![]() where

where ![]() day and is such that

day and is such that

![]() year.

year.

![[*]](crossref.png) , that

, that

![[*]](crossref.png) that the price

that the price ![[*]](crossref.png) of this chapter, show that

of this chapter, show that

![]() and

and

![]() as a function of the strike

as a function of the strike ![]() .

.

![]() and zero coupon bonds with maturity

and zero coupon bonds with maturity

![]() .

.

![]() (successively chosen to be

(successively chosen to be ![]() day,

day, ![]() week,

week,

![]() month) sample the residual risk of this approximated hedging

portfolio. Plot a histogram of the residual risk and study the

values of its mean and its variance when

month) sample the residual risk of this approximated hedging

portfolio. Plot a histogram of the residual risk and study the

values of its mean and its variance when ![]() decreases to

decreases to ![]() .

.