Contents

1 A look at annual data from stock French market

1.1 Annual historical returns

Here are data from http://www.euronext.com

Indice CAC40 Performance

Fin année Indice prix % Indice prix

Rentabilité nette % Rentabilité nette

31/12/1987 1000,00 - 1000,00 -

30/12/1988 1573,94 57,39% 1606,82 60,68%

29/12/1989 2001,08 27,14% 2082,58 29,61%

28/12/1990 1517,93 -24,14% 1609,91 -22,70%

31/12/1991 1765,66 16,32% 1916,19 19,02%

31/12/1992 1857,78 5,22% 2060,31 7,52%

31/12/1993 2268,22 22,09% 2570,48 24,76%

30/12/1994 1881,15 -17,06% 2176,64 -15,32%

29/12/1995 1871,97 -0,49% 2213,92 1,71%

31/12/1996 2315,73 23,71% 2795,90 26,29%

31/12/1997 2998,91 29,50% 3684,87 31,80%

30/12/1998 3942,66 31,47% 4908,03 33,19%

30/12/1999 5958,32 51,12% 7515,81 53,13%

29/12/2000 5926,42 -0,54% 7550,48 0,46%

28/12/2001 4624,58 -21,97% 5975,25 -20,86%

31/12/2002 3063,91 -33,75% 4032,77 -32,51%

31/12/2003 3557,90 16,12% 4785,01 18,65%

31/12/2004 3821,16 7,40% 5268,31 10,10%

30/12/2005 4715,23 23,40% 6669,63 26,60%

29/12/2006 5541,76 17,53% 8061,85 20,87%

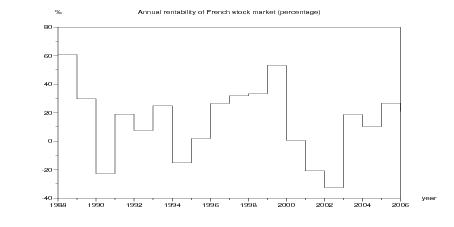

Question 1 Draw different graphical representations of the historical annual rentability of

French stock market (in percentage).

//

years=1988:2006 ;

cac40_perf_percent=[60.68 29.61 -22.70 19.02 7.52 ...

24.76 -15.32 1.71 26.29 31.80 33.19 53.13 0.46 -20.86 ...

-32.51 18.65 10.10 26.60 20.87] ;

xset('window',40) ; xbasc();

plot2d2(years,cac40_perf_percent);

xtitle('Annual rentability of French stock market (percentage)',...

'year','%')

xset('window',41) ; xbasc();

plot2d(sort(cac40_perf_percent));

xtitle('Sorted annual rentability of French stock market (percentage)')

xset('window',42) ; xbasc();

histplot((-40):20:70,cac40_perf_percent);

//

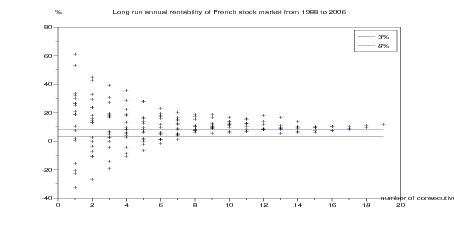

1.2 Equivalent annual historical returns

Suppose that you choose an investment duration of T years. You invest at the beginning of any

year between 1988 and 2006 − T + 1, and you compare the final value with what an investment

with safe return would have given on the same duration T. We shall call the return for which both

are equivalent the historical equivalent annual rentability. Letting the year between 1988 and

2006 − T + 1 vary, we obtain, for each investment duration T, an array of historical equivalent

annual rentabilities.

Question 2 Compute the historical equivalent annual rentabilities of French stock market

over 1,2, …, 19 consecutive years. Draw a graphic with the number of consecutive years as

horizontal axis and the historical rentabilities as vertical axis.

//

t0=years(1);

tf=years($);

duration=1:(tf-t0+1);

cac40_equi_returns=list();

// cac40_equi_returns(k) is the vector of

// equivalent annual returns over k consecutive years

xset('window',43) ; xbasc() ;

for i=duration;

loc_vec=[];

for j=1:(tf-t0-i+2);

loc=cumprod(1 + 0.01 *cac40_perf_percent(j:(j+i-1)));

loc_vec=[loc_vec,(loc($))^{1/i}-1];

end

plot2d(i*ones(loc_vec),100*loc_vec,style=-1)

cac40_equi_returns(i)=100*loc_vec;

end

xtitle('Long run annual rentability of French stock market from '...

+string(t0) +' to ' +string(tf) ,...

'nb consecutive years','%')

plot2d([0 duration], ones([0 duration]') * [3 8] ); // ,style=[2 3]);

legends([ '3%'; '8%' ] , [1,2], 'ur' );

//

1.3 Regular investment

Consider tf − t0 + 1 periods t0, t0 + 1, …, tf (which will be years in this context). Investing a

unitary amount of money at the beginning of period t is supposed to return 1 + ℛ(t) at

the beginning of period t + 1. Thus, if your planning strategy is to invest ℐ(t) at the

beginning of every period t ∈{t0,t0 + 1,…,tf}, you can evaluate your fortune at the horizon

T = tf + 1.

//

function [capital,plus_values]=reg_invest(invest_tab,return_tab)

periods=cumsum(ones(invest_tab)) ;

cumul_invest=cumsum(invest_tab);

// invest_tab : array of regular investment amounts

// return_tab : array of returns

// capital : at last period 1+periods($)

capital=[];

plus_values=[];

for t=periods

capital_loc= ( capital($) + invest_tab(t) ) * (1+return_tab(t)) ;

capital=[capital capital_loc];

plus_values=[plus_values capital_loc-cumul_invest(t) ] ;

end

endfunction

//

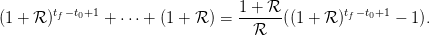

Question 3 Suppose now that the same strategy is applied with a fixed return ℛ, giving

fortune at the horizon T = tf + 1

Which is the fixed rate ℛs which gives the same final fortune than with a time-varying return

ℛ(⋅)?

//

function retour=equi_return(nb_periods,fortune)

function y=f(rate)

y=( 1 + (1 ./rate) ) .* ( (1+rate).^(nb_periods) -1 ) - fortune ;

endfunction

retour=fsolve(0.03,f)

endfunction

//

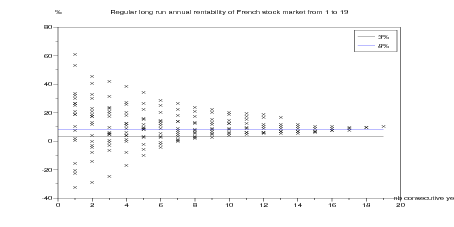

1.4 Equivalent annual historical returns for yearly investment strategy

Question 4 Suppose you invest a unitary amount of money at the beginning of every year

in the stock market. Evaluate the equivalent fixed rates, on different horizons, of the strategy

consisting of investing the same amount every year on the stock market.

//

t0=years(1);

tf=years($);

duration=1:(tf-t0+1);

cac40_equi_yearly_returns=list();

// cac40_equi_returns(i) is the vector of

// equivalent annual returns for regular annual investment

// over i consecutive years

xset('window',63) ; xbasc() ;

for i=duration;

loc_vec=[];

for j=1:(tf-t0-i+2);

// loop when the investment horizon i is fixed

return_tab=0.01*cac40_perf_percent(j:(j+i-1));

invest_tab=ones(return_tab);

// unitary amount of regular annual investment

[capital,plus_values]=reg_invest(invest_tab,return_tab);

nb_periods=sum(ones(invest_tab));

fortune=capital($);

retour=equi_return(nb_periods,fortune);

loc_vec=[loc_vec,retour];

end

plot2d(i*ones(loc_vec),100*loc_vec,style=-2);

cac40_equi_yearly_returns(i)=100*loc_vec;

end

xtitle('Yearly investment in French stock market from '...

+string(t0) +' to ' +string(tf) ...

+': annual rentability',...

'nb consecutive years','%')

plot2d([0 duration], ones([0 duration]') * [3 8] );

legends([ '3%'; '8%' ] , [1,2], 'ur' );

//

2 Perception of the risk of stock market on different investment durations

2.1 Historical returns on fixed investment duration

Suppose that you choose an investment duration of T years and an initial capital of 1 000 euros.

Consider that the investment may have started at the beginning of any year between 1988 and

2006 − T + 1. Letting the year between 1988 and 2006 − T + 1 vary, we obtain, for

each investment duration T, an array of historical returns. For T = 1 year, we obtain

2006 − 1988 + 1 = 19 historical returns; for T = 2 years, 18 years; …; for T = 19, only 1 historical

return.

Question 5 Draw graphics for T = 1, T = 2, T = 10 with years between 0 and T in abcisse

and a straight line joining 1 000 euros to the different historical returns. The straight lines

ignore the variability during the investment period to focus only on the final return.

//

t0=years(1);

tf=years($);

duration=1:(tf-t0+1);

cac40_hist_returns=list();

// cac40_hist_returns(i) is the vector of

// returns over i consecutive years for 1000 euros investment

for i=duration;

loc_vec=[];

for j=1:(tf-t0-i+2);

loc=1000*cumprod(1 + 0.01 *cac40_perf_percent(j:(j+i-1)));

// for 1000 euros investment

loc_vec=[loc_vec,loc($)];

end

cac40_hist_returns(i)=loc_vec;

end

for i=[1 2 5 8 12]

xset('window',70+i) ; xbasc() ;

plot2d([0 i],[1000*ones(cac40_hist_returns(i)')...

cac40_hist_returns(i)' ]')

xtitle('Stock market historical returns after ' +string(i) +...

' investment years','years')

xpoly([0 i],[1000 1000*(1+.03)^i] ,"lines",0)

p=get("hdl"); //get handle on current entity (here the polyline entity)

p.thickness=6;

p.line_style=5;

end

//

2.2 CPT evaluation of risky historical returns on fixed investment durations

For each number T of consecutive years, one has an array of historical returns, supposed to be the

values taken by a prospect X(T) with equal probabilities. We shall evaluate X(T) with the so

called Cumulative prospect theory or CPT (see [KT79, TK92]), presented in Risk and

Decision.

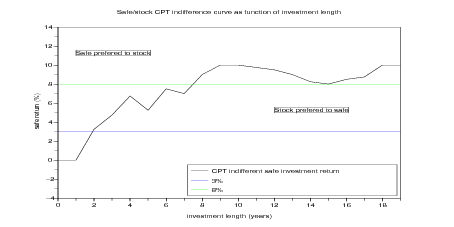

Question 6 Draw the evaluation of the prospect X(T) as a function of investment duration

T. Where do you see that the stock market is not chosen if its returns are only perceived

on an annual basis? What is the investment time needed to prefer stock market to a safe

investment between 2% and 3% [BT95]?

//

// exec Code/CPT.sci

anchors_percent=0:0.25:10 ;

Values=zeros(anchors_percent'*duration);

for i=duration;

values=cac40_hist_returns(i);

lotery=[ values ; (1/sum(ones(values)))*ones(values) ] ;

// deff('y=f(x)','y=CPT_eval(lotery,x)');

// indif_anch(i)=fsolve(3,f);

loc_Values=[];

for k=1:prod(size(anchors_percent));

anchor=1000* (1+0.01*anchors_percent(k))^i ;

loc_Values=[loc_Values;CPT_eval(lotery,anchor)];

end

// Values(k,:)=loc_Values;

Values(:,i)=loc_Values;

end

xset('window',65) ; xbasc() ;

plot2d(duration,[zeros(duration)' Values([1 9 13],:)']);

xtitle('CPT evaluation of historical stock market returns', ...

'investment length (years)');

legends([ 'anchor '+string(anchors_percent(1))+'%'; ...

'anchor '+string(anchors_percent(9))+'%' ; ...

'anchor '+string(anchors_percent(13))+'%'],...

[2 3 4], 'ul');

[lhs,ind]=mini(abs(Values),"r");

CPT_indif=anchors_percent(ind);

xset('window',66) ; xbasc() ;

plot2d([0 duration], ...

[ [0 CPT_indif]' ones([0 duration]') * [3 8] ],...

rect=[0,-4,duration($),14]);

legends([ 'CPT indifferent safe investment return' ; '3%'; '8%' ] , ...

[1,2,3], 'lr' );

xstring(1,11,["Safe prefered to stock"],0,1)

xstring(12,5,["Stock prefered to safe"],0,1)

xtitle('Safe/stock CPT indifference curve ...

as function of investment length','investment length (years)',...

'safe return (%)');

//

3 Perception of the risk of regular investment in stock market

3.1 Historical returns for regular investment in stock market

Suppose that you choose an investment duration of T years and a regular investment of

1 000 euros at the beginning of each year. Consider that the investment may have started at the

beginning of any year between 1988 and 2006 − T + 1. Letting the year between 1988 and

2006 − T + 1 vary, we obtain, for each investment duration T, an array of historical returns. For

T = 1 year, we obtain 2006 − 1988 + 1 = 19 historical returns; for T = 2 years, 18 years; …; for

T = 19, only 1 historical return.

Question 7 Draw graphics for T = 1, T = 2, T = 10 with years between 0 and T in abcisse

and a straight line joining 1 000 euros to the different historical returns. The straight lines

ignore the variability during the investment period to focus only on the final return.

//

t0=years(1);

tf=years($);

duration=1:(tf-t0+1);

cac40_yearly_invest_returns=list();

// cac40_yearly_invest_returns(i) is the vector of

// returns for regular annual investment

// over i consecutive years

for i=duration;

loc_vec=[];

for j=1:(tf-t0-i+2);

// loop when the investment horizon i is fixed

return_tab=0.01*cac40_perf_percent(j:(j+i-1));

invest_tab=ones(return_tab);

// unitary amount of regular annual investment

[capital,plus_values]=reg_invest(invest_tab,return_tab);

loc_vec=[loc_vec,capital($)];

end

cac40_yearly_invest_returns(i)=1000*loc_vec;

// for 1000 euros annual investment

end

for i=[1 2 5 8 12]

xset('window',90+i) ; xbasc() ;

plot2d([0 i],[1000*ones(cac40_yearly_invest_returns(i)') ...

cac40_yearly_invest_returns(i)' ]')

xtitle('Regular investment returns after ' +string(i) +...

' investment years','years')

return_tab=0.03*ones(1:i);

// investment of length i

invest_tab=ones(return_tab);

// unitary amount of regular annual investment

[capital,plus_values]=reg_invest(invest_tab,return_tab);

xpoly([0 i],[1000 1000*capital($)] ,"lines",0)

p=get("hdl"); //get handle on current entity (here the polyline entity)

p.thickness=6;

p.line_style=5;

end

//

3.2 CPT evaluation of historical returns for regular investment in stock market

Suppose that you choose an investment duration of T years and a regular investment of

1 000 euros at the beginning of each year. For each number T of consecutive years, one has an

array of historical returns, supposed to be the values taken by a prospect Y (T) with equal

probabilities. We shall evaluate X(T) with the CPT.

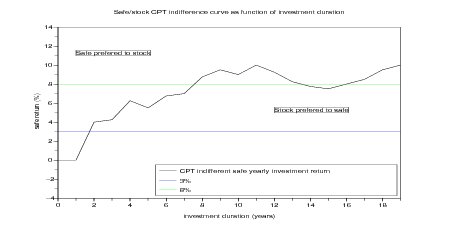

Question 8 Draw the evaluation of the prospect Y (T) as a function of investment duration

T. Where do you see that the stock market is not chosen if its returns are only perceived

on an annual basis? What is the investment time needed to prefer stock market to a safe

investment between 2% and 3% [BT95]?

//

// exec Code/CPT.sci

anchors_percent=0:0.25:10 ;

Values=zeros(anchors_percent'*duration);

for i=duration;

values=cac40_yearly_invest_returns(i);

lotery=[ values ; (1/sum(ones(values)))*ones(values) ] ;

// deff('y=f(x)','y=CPT_eval(lotery,x)');

// indif_anch(i)=fsolve(3,f);

loc_Values=[];

for k=1:prod(size(anchors_percent));

return_tab=0.01*anchors_percent(k)*ones(1:i);

// investment of duration i

invest_tab=ones(return_tab);

// unitary amount of regular yearly investment

[capital,plus_values]=reg_invest(invest_tab,return_tab);

anchor=1000* capital($);

// for 1000 euros annual investment

loc_Values=[loc_Values;CPT_eval(lotery,anchor)];

end

// Values(k,:)=loc_Values;

Values(:,i)=loc_Values;

end

xset('window',105) ; xbasc() ;

plot2d(duration,[zeros(duration)' Values([1 9 13],:)']);

xtitle('CPT evaluation of stock market returns ...

with yearly investment', ...

'investment duration (years)');

legends([ 'anchor '+string(anchors_percent(1))+'%'; ...

'anchor '+string(anchors_percent(9))+'%' ; ...

'anchor '+string(anchors_percent(13))+'%'],...

[2 3 4], 'ul');

[lhs,ind]=mini(abs(Values),"r");

CPT_indif_yearly=anchors_percent(ind);

xset('window',106) ; xbasc() ;

plot2d([0 duration], ...

[ [0 CPT_indif_yearly]' ones([0 duration]') * [3 8] ],...

rect=[0,-4,duration($),14]);

legends([ 'CPT indifferent safe yearly investment return' ; '3%'; '8%' ] , ...

[1,2,3], 'lr' );

xstring(1,11,["Safe prefered to stock"],0,1)

xstring(12,5,["Stock prefered to safe"],0,1)

xtitle('Safe/stock CPT indifference curve ...

as function of investment duration','investment duration (years)',...

'safe return (%)');

xset('window',166) ; xbasc() ;

plot2d([0 duration], ...

[ [0 CPT_indif]' [0 CPT_indif_yearly]' ...

ones([0 duration]') * [3 8] ],...

rect=[0,-4,duration($),14]);

legends([ 'CPT indifferent safe investment return' ; ...

'CPT indifferent safe yearly investment return' ; '3%'; '8%' ] , ...

[1,2,3,4], 'lr' );

xtitle('Safe/stock CPT indifference curves ...

as function of investment duration','investment duration (years)',...

'safe return (%)');

//

References

[BT95] Shlomo Benartzi and Richard H Thaler. Myopic loss aversion and the equity

premium puzzle. The Quarterly Journal of Economics, 110(1):73–92, February

1995. available at http://ideas.repec.org/a/tpr/qjecon/v110y1995i1p73-92.html.

[KT79] D. Kahneman and A. Tversky. Prospect theory: an analysis of decision under

risk. Econometrica, 47:263–291, 1979.

[TK92] Amos Tversky

and Daniel Kahneman. Advances in prospect theory: Cumulative representation of

uncertainty. Journal of Risk and Uncertainty, 5(4):297–323, October 1992. available

at http://ideas.repec.org/a/kap/jrisku/v5y1992i4p297-323.html.